tax shelter real estate investment

There are 1838 investment opportunities in BELLE MEAD NJ. For each two dollars of AGI over 100000 the 25000 limit is reduced by one dollar.

The Tax Free Exchange Loophole How Real Estate Investors Can Profit From The 1031 Exchange Cummings Jack 0723812718344 Amazon Com Books

Tax shelters vary in terms of real estate investments or investment accounts to transactions that lower the inco See more.

. The result is that rental real estate is a secret tax shelter that few people ever consider. See reviews photos directions phone numbers and more for the best Real Estate Investing in Iselin NJ. To begin with what are tax shelters.

And if you hold that stock for over one year you would be charged long-term capital gains rather than ordinary income tax. And its an investment asset. To see how a real.

After 2012 28 tax reforms brackets have changed. A tax shelter is a vehicle used by taxpayers to minimize or decrease their taxable incomes and therefore tax liabilities. While retirement-related tax shelters rank right at the top of the list real estate investing is among the top tax shelters as well.

EDT 2 Min Read. As of March 21. NYREI offers salesperson licensing and remedial courses to help you stay up-to-date on your real estate classes.

In simple terms a tax shelter is a means for real estate investors and property owners to store assets so that their current and future tax rates are minimized to the fullest. July 16 2015 331 pm. For singles for example from 0 to 10000 they pay 10 from 10000 to 40000 they pay 12 from 40000 to 80000 they.

212 967 - 7508. Therefore an investor whose adjusted gross income is 120000 would be limited to a 15000 tax. As knowledgeable replacement property professionals they help clients build a customized strategy that identifies suitable investments pursuing successful completion of a.

See reviews photos directions phone numbers and more for the best Real Estate Investing in Middlesex NJ. To shelter real estate investment cash flow from taxes emphasize to investors that they can buy like-kind properties through tax-free exchanges also referred to as a Section. Story continues below.

IMGCAP 1In every country Ive been in real estate is the best tax shelter said Tom Wheelwright CPA an advisor and speaker at. 2021 Shelter Real Estate Investment Strategies. Visit us online for dates and times.

Buying stock in real estate is an investment. Tax shelters can range from investments or. Contact Home Tel.

Real Estate Investing in BELLE MEAD NJ. 12 investment properties are listed for sale and 80 are off-market.

Your Guide To Investment Property Depreciation Than Merrill

Tax Shelters Definition Types Examples Of Tax Shelter

Ex I R S Agent Says Tax Evasion By Real Estate Partners Is Huge The New York Times

Advantages And Disadvantages Of Real Estate Investing Investogram

Rei Wealth Monthly Issue39 Page 13

Tax Benefits Of Investing In Multi Family Real Estate

Solo 401k Real Estate Investment Faqs

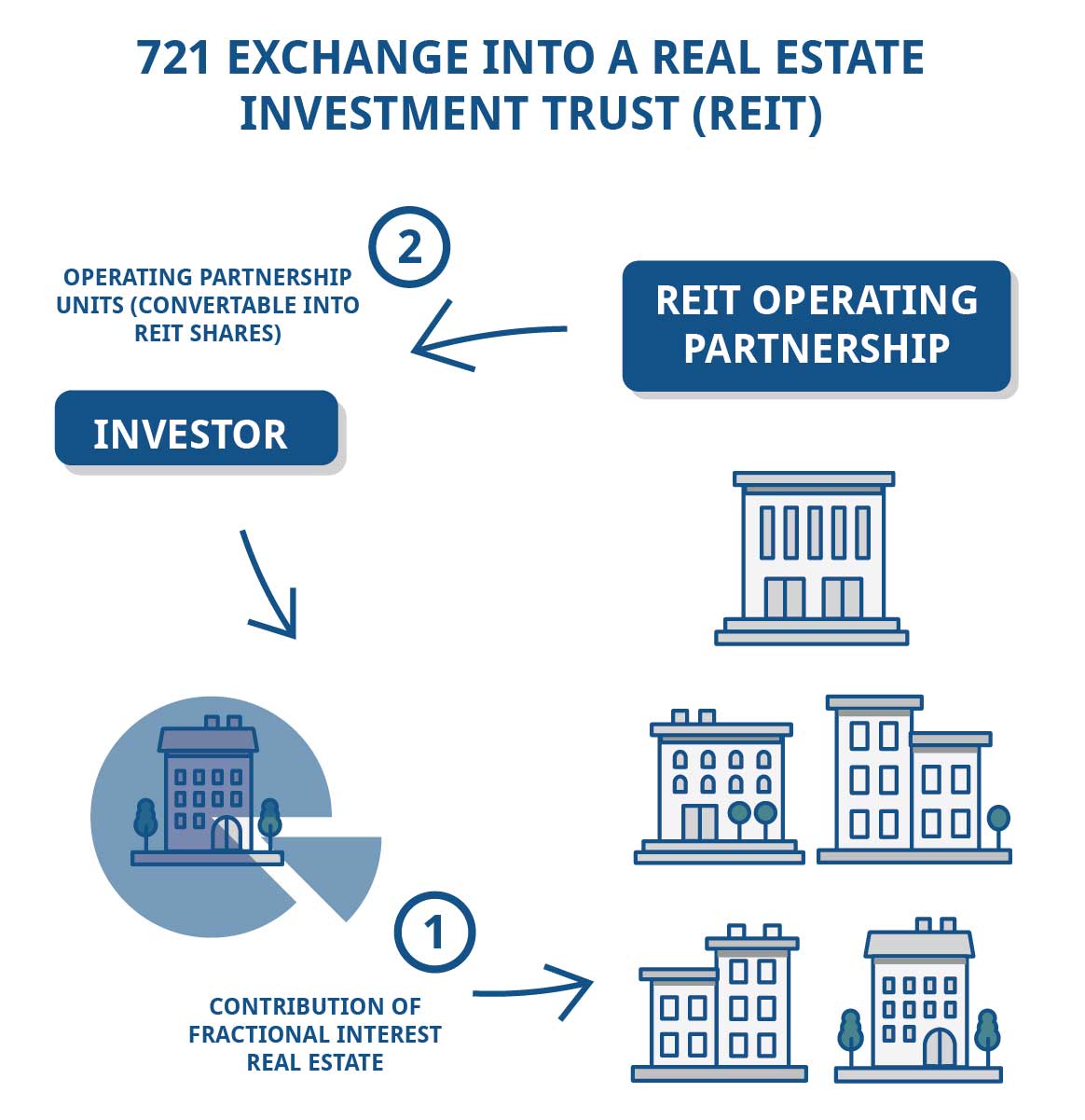

Introduction To The 721 Exchange Jrw Investments

Tax Shelter Options For Fix Flips And Rental Properties

1 Best 1031 Exchange Fund California 5 Star Rated

The Best Tax Benefits Of Real Estate Investing Fortunebuilders

To Pay For The Pandemic Dry Out The Tax Havens And Make Apple Pay Taxes

Dst Real Estate Investments 1031 Exchange Kingsbarn Realty Capital

5 Ways Land Can Shelter Income From Taxes Accounting Today

Ways For Investors To Leverage Real Estate During Inflation

The Best Tax Benefits Of Real Estate Investing Fortunebuilders

Tax Troubles For Some Investors In Vanguard S Target Date Funds The New York Times

Tax Shelters For High W 2 Income Every Doctor Must Read This